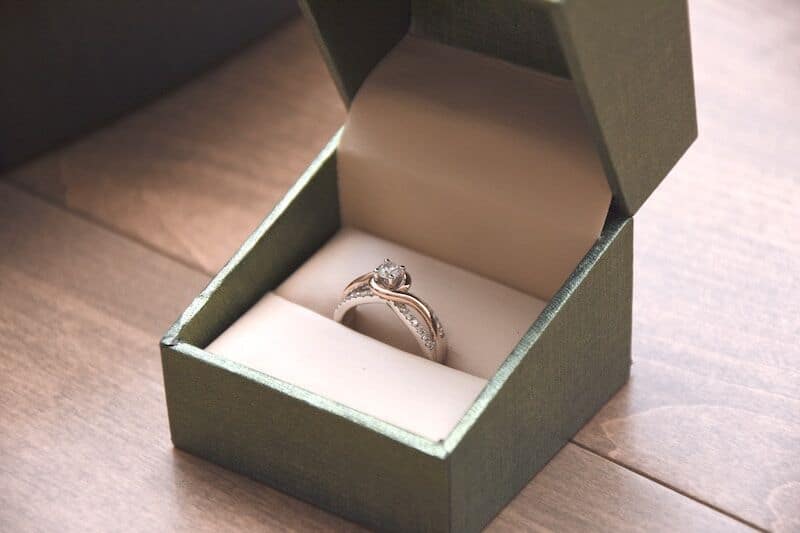

Here's what you need to know about insuring your engagement ring.

If you've decided to propose, then you have likely given your engagement a lot of thought. However, in your excitement, you should not forget to secure insurance coverage for the ring. While this might not seem super romantic, taking this step will give you major peace of mind. Here's what you need to know about securing insurance for your engagement ring.

When it comes to insuring your engagement ring, you have some options. You can choose to secure coverage by tacking an endorsement onto your homeowners insurance policy or renters policy. You also have the option to secure a specialty policy from an insurance company that specializes in jewelry policies. When you go with these specialty policies, they tend to offer higher coverage limits and more coverage options to better meet your needs.

When you go to secure engagement ring coverage, you will need to provide your receipts and an appraisal of the ring to your insurer. Normally you can get an appraisal from a certified gemologist for a small fee.

The approximate annual cost of ring insurance is about $1 to $2 for every $100 that it would cost to replace. This means that, if your ring costs $9,000 to replace, then your annual insurance premiums would be around $90-$180.

This is what you need to know about securing insurance for your engagement ring. Do you have further questions regarding your personal property coverage? If so, then

contact the experts at

East End Insurance Agency. We are ready to get you covered today.